- Education

- Introduction to Trading

- Natgas Trading and Natural Gas Prices

Natgas Trading and Natural Gas Prices

The world runs on energy, and natural gas is a major player in that game. But it's not just about heating homes and powering factories - it's also a financial instrument, traded on global markets by investors and traders like you.

Let’s explore NatGas trading together. In this article we are going to explain the web of contracts, explore the key players, and also talk about forces that shape the price of this NatGas.

What is NatGas Trading

NatGas trading (commodity trading) is the buying and selling of contracts that speculate on the future price of natural gas. It's essentially betting on whether the price will go up (going long) or down (going short) at a certain point in the future.

What is Natural Gas?

Natural gas is a fossil fuel used for electricity generation, heating homes and businesses, and in industrial processes. It's a crucial commodity with constantly fluctuating prices, making it attractive for trading.

What are you Actually Trading?

While you might imagine physically trading gas pipelines, NatGas trading primarily involves contracts, such as:

- Futures contracts: These lock in a price for delivery of a specific amount of gas at a future date. Traders bet on whether the price will be higher or lower at that time.

- Options contracts: These give you the right, but not the obligation, to buy or sell gas at a specific price by a certain date. They offer less risk than futures but also lower potential profits.

- Contracts for Difference (CFDs): These track the price of natural gas futures and allow you to speculate on its movement without taking physical delivery.

- Natural gas-related stocks and ETFs: These invest in companies involved in the exploration, production, or transportation of natural gas, offering indirect exposure to the price movement.

You can trade NatGas on various platforms, like the New York Mercantile Exchange (NYMEX), through brokers like IFC Markets or online trading accounts.

Why trade NatGas?

Natural gas is a volatile commodity, meaning its price can fluctuate significantly. This can create opportunities for large profits if you predict the price movement correctly.

Companies that use natural gas in their operations can hedge against price fluctuations by taking opposite positions in NatGas contracts.

Adding NatGas to your portfolio can help diversify your holdings and potentially reduce overall risk.

What is the Natgas Market?

The Natgas market, or the natural gas market, is a global network for buying and selling natural gas, a fossil fuel used for electricity generation, heating, and industrial processes. It's a complex system with various interconnected segments, each with its own dynamics and players.

NatGas Market Structure

The NatGas market is divided into several regional markets, primarily:

- North America: Dominated by the Henry Hub, the benchmark pricing point for US natural gas.

- Europe: Characterized by interconnected pipelines and hubs like the Dutch TTF.

- Asia: Largely dependent on Liquefied Natural Gas (LNG) imports, with hubs like Japan's JKM.

The market comprises two main segments:

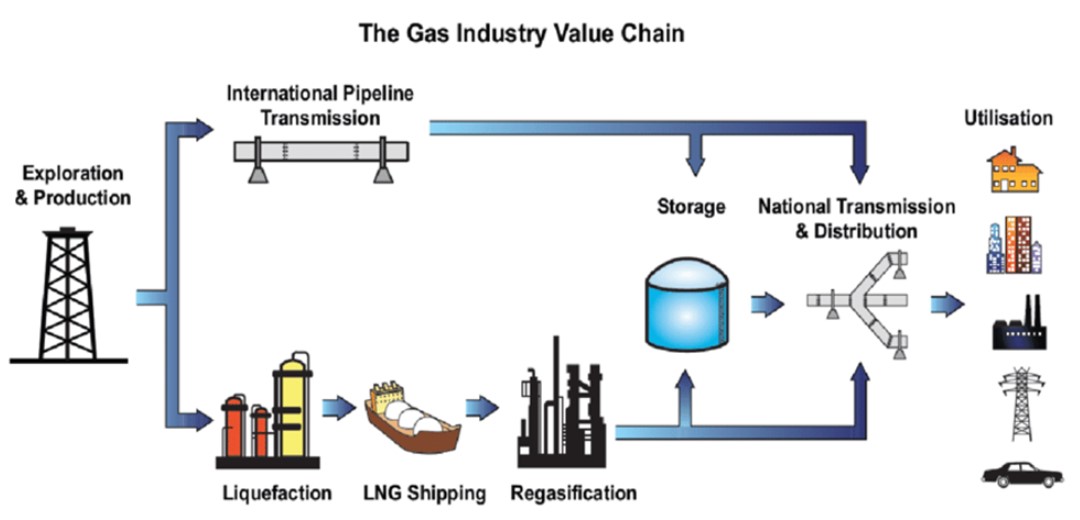

- Physical market: Where actual natural gas is traded through pipelines and LNG transportation.

- Financial market: Where contracts based on future natural gas prices are traded on exchanges.

Who Are The Key Players

The natural gas market is made up of a number of different players, each with their own role to play. Producers extract natural gas from underground formations, while pipelines and LNG operators transport it to market.

Storage facilities store natural gas so that it can be used when needed, while distributors deliver it to end-users. Retailers sell natural gas directly to consumers, while traders and speculators buy and sell natural gas contracts in order to make a profit.

| Role | Companies | Description |

| Producers | ExxonMobil, Chevron, Shell, Gazprom, PetroChina | Extract natural gas from underground formations through drilling and other methods. |

| Pipelines & LNG Operators | TransCanada, Kinder Morgan, Cheniere Energy, Gazprom, LNG Japan | Transport natural gas through pipelines or Liquefied Natural Gas (LNG) tankers across land and water. |

| Storage Facilities | NGTL Storage & Transportation, Dominion Energy, Antero Resources, Gazprom, Storengy | Maintain underground storage facilities to hold natural gas reserves for peak demand periods. |

| Distributors | Southern California Gas Company, National Grid, NiSource, Gazprom, China Gas Group | Deliver natural gas to end-users through local pipeline networks within specific regions or countries. |

| Retailers | Constellation Energy, NRG Energy, Exelon, Gazprom, CNPC | Sell natural gas directly to consumers for residential, commercial, and industrial uses. |

| Traders & Speculators | Vitol, Glencore, Trafigura, Mercuria, Gunvor | Buy and sell natural gas contracts on exchanges and marketplaces, speculating on future price movements. |

NatGas Market Challenges

- Environmental concerns: Burning natural gas emits greenhouse gases, contributing to climate change.

- Price volatility: Natural gas prices can be highly volatile due to various factors, making it a risky market for some participants.

- Geopolitical instability: Disruptions in production or transportation due to political events can have significant impacts on the market.

What Affects NatGas Prices

Several factors influence natural gas prices, creating a complex interplay between supply and demand.

Here are some key ones, with current examples:

1. Supply and Demand

Supply:

- Production levels: Increased production, like the recent surge in US shale gas, can lead to lower prices due to excess supply. However, production slowdowns due to equipment delays or environmental regulations can tighten supply and push prices up.

- Storage levels: Low storage levels before winter, like the current situation in Europe, can raise concerns about sufficient reserves and drive prices higher.

- Geopolitical events: Disruptions in major producing or exporting countries, like the ongoing conflict in Ukraine, can disrupt supply chains and significantly impact prices.

Demand:

- Weather: Colder-than-expected winters, like the recent one in North America, can increase demand for heating, leading to price spikes. Conversely, mild weather can dampen demand and lower prices.

- Economic activity: Strong economic growth, as seen in parts of Asia, can boost demand for industrial and commercial uses of natural gas, driving prices up. Conversely, economic slowdowns can weaken demand and put downward pressure on prices.

- Alternatives: The availability and price of alternative fuels like coal, oil, and renewables can influence natural gas demand and prices. For example, high coal prices can make natural gas a more attractive option, boosting its demand and price.

2. Infrastructure

- Pipelines and LNG capacity: Limited pipeline capacity or disruptions in key infrastructure, like the recent pipeline explosion in Mexico, can restrict gas flow and create regional price variations.

- Storage facilities: Inadequate storage capacity can make it difficult to meet peak demand during winter, leading to higher prices.

3. Financial Markets

- Futures and options trading: Speculative activity in the financial market can influence physical market prices, with large buying or selling orders impacting short-term price movements.

Let’s see some examples of how NatGas prices are influenced:

- US Price Drop: The recent decline in US natural gas prices is partly due to increased domestic production and milder winter weather, leading to lower demand.

- European Price Fluctuations: Europe's natural gas prices remain high compared to the US due to factors like lower storage levels, limited LNG import capacity, and ongoing reliance on Russian gas amidst the Ukraine conflict.

- Global LNG Market: The global LNG market has seen increased competition for limited supplies, leading to higher prices for countries like Japan and South Korea, heavily reliant on LNG imports.

Bottom Line

NatGas trading isn't just a game for Wall Street sharks. It's a complex dance between global forces, infrastructure limitations, and the ever-changing needs of a resource-hungry planet.

Understanding these dynamics can empower you to make informed choices about your energy consumption and investments, while also offering a glimpse into the interconnected web that shapes our world.

Remember, the price of your next gas bill isn't just a random number; it's a story woven from threads of supply, demand, and the invisible hand of the market. So, the next time you turn on the heat or fire up the grill, take a moment to appreciate the intricate ballet of NatGas trading that keeps the flames of our lives burning.